All Categories

Featured

In 2020, an estimated 13.6 million united state families are approved capitalists. These houses manage substantial wide range, estimated at over $73 trillion, which represents over 76% of all private wide range in the U.S. These investors participate in financial investment opportunities generally inaccessible to non-accredited investors, such as investments in private business and offerings by particular hedge funds, private equity funds, and financial backing funds, which allow them to expand their wealth.

Read on for details about the most recent certified capitalist modifications. Capital is the gas that runs the economic engine of any kind of country. Banks generally money the majority, yet hardly ever all, of the resources called for of any kind of procurement. After that there are scenarios like startups, where financial institutions do not supply any kind of financing whatsoever, as they are unverified and considered high-risk, but the need for resources stays.

There are mainly 2 regulations that enable issuers of securities to provide unlimited amounts of protections to investors. accredited investor defined. Among them is Regulation 506(b) of Guideline D, which allows an issuer to market safety and securities to unrestricted accredited investors and up to 35 Sophisticated Financiers only if the offering is NOT made with basic solicitation and basic advertising

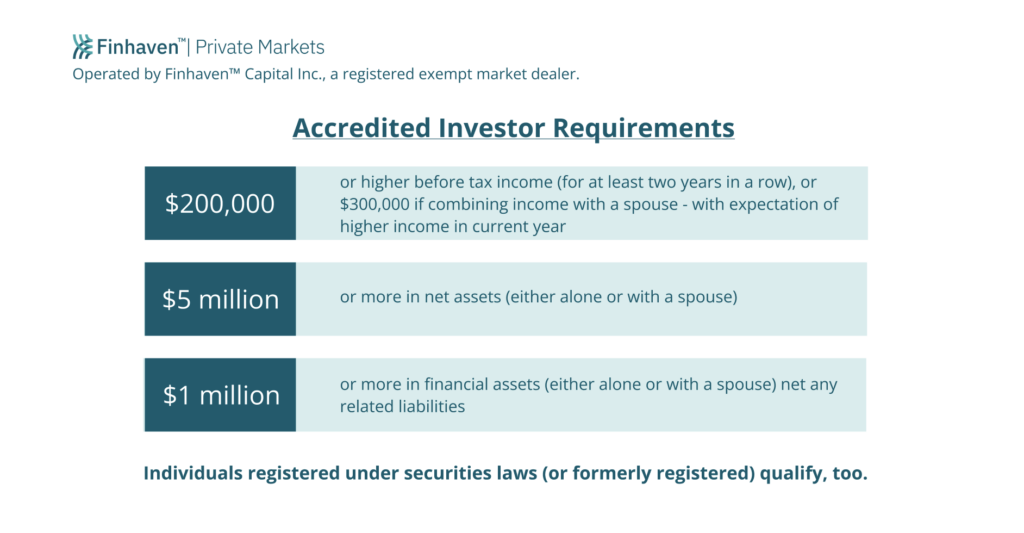

The freshly embraced amendments for the very first time accredit private financiers based on economic sophistication requirements. The amendments to the certified capitalist interpretation in Guideline 501(a): consist of as accredited investors any count on, with complete assets a lot more than $5 million, not created particularly to acquire the subject protections, whose acquisition is guided by an advanced individual, or include as certified investors any entity in which all the equity owners are accredited capitalists.

There are a number of enrollment exceptions that eventually broaden the world of possible investors. Lots of exemptions call for that the investment offering be made only to individuals who are accredited financiers (sec regulation d rule 501).

Additionally, certified investors usually obtain extra positive terms and greater potential returns than what is readily available to the general public. This is since personal placements and hedge funds are not called for to abide by the exact same regulative needs as public offerings, enabling for more flexibility in regards to financial investment techniques and possible returns.

Accredited Investor Requirements 2022

One reason these security offerings are restricted to recognized capitalists is to make sure that all participating capitalists are economically sophisticated and able to look after themselves or maintain the risk of loss, therefore making unnecessary the protections that originate from a licensed offering. Unlike security offerings registered with the SEC in which particular info is called for to be revealed, companies and private funds, such as a hedge fund - accredited individual investor or financial backing fund, involving in these excluded offerings do not need to make recommended disclosures to certified financiers.

The web worth examination is relatively simple. Either you have a million dollars, or you don't. However, on the earnings test, the individual should satisfy the limits for the 3 years constantly either alone or with a spouse, and can not, for instance, please one year based upon private revenue and the next 2 years based upon joint earnings with a partner.

Latest Posts

Tax Sale Excess Funds

Surplus Tax Sale

Over The Counter Tax Lien