All Categories

Featured

Table of Contents

RealtyMogul's minimum is $1,000. The rest of their commercial realty bargains are for accredited capitalists just. Below is a thorough RealtyMogul overview. If you desire broader genuine estate direct exposure, then you can consider getting a publicly traded REIT. VNQ by Vanguard is just one of the largest and well understood REITs.

Their number one holding is the Vanguard Real Estate II Index Fund, which is itself a common fund that holds a selection of REITs. There are various other REITs like O and OHI which I am a long-time shareholder of.

To be an certified financier, you should have $200,000 in annual earnings ($300,000 for joint capitalists) for the last two years with the assumption that you'll gain the exact same or much more this year. You can also be taken into consideration a recognized capitalist if you have a total assets over $1,000,000, individually or collectively, excluding their key home.

How do I choose the right Accredited Investor Real Estate Investment Groups for me?

These offers are usually called exclusive placements and they do not require to sign up with the SEC, so they do not give as much info as you 'd anticipate from, claim, an openly traded business. The recognized capitalist demand assumes that someone that is certified can do the due persistance by themselves.

You simply self-accredit based on your word. The SEC has actually also expanded the meaning of certified investor, making it less complicated for more individuals to qualify. I'm bullish on the heartland of America give after that lower appraisals and a lot higher cap prices. I believe there will certainly be proceeded migration far from high expense of living cities to the heartland cities because of set you back and technology.

It's everything about adhering to the cash. In enhancement to Fundrise, likewise take a look at CrowdStreet if you are a recognized financier. CrowdStreet is my preferred platform for accredited capitalists because they focus on arising 18-hour cities with lower evaluations and faster populace development. Both are complimentary to subscribe and discover.

Below is my property crowdfunding control panel. If you intend to discover more about actual estate crowdfunding, you can visit my property crowdfunding learning center. Sam functioned in spending financial for 13 years. He received his bachelor's degree in Economics from The University of William & Mary and obtained his MBA from UC Berkeley.

He hangs around playing tennis and caring for his family. Financial Samurai was started in 2009 and is among one of the most relied on personal financing sites online with over 1.5 million pageviews a month.

With the U.S. actual estate market on the surge, capitalists are looking with every offered home kind to find which will aid them earnings. Which fields and homes are the finest steps for capitalists today?

Are there budget-friendly Real Estate Investment Networks For Accredited Investors options?

Each of these types will certainly feature distinct advantages and downsides that capitalists ought to examine. Allow's take a look at each of the alternatives offered: Residential Property Commercial Property Raw Land & New Building Property Investment Trusts (REITs) Crowdfunding Platforms Register to participate in a FREE on the internet real estate course and find out exactly how to get begun purchasing property.

Other homes consist of duplexes, multifamily homes, and villa. Residential property is perfect for numerous investors since it can be simpler to transform earnings regularly. Obviously, there are several property property investing methods to deploy and different levels of competition across markets what might be ideal for one investor might not be best for the next.

How do I choose the right Accredited Investor Property Portfolios for me?

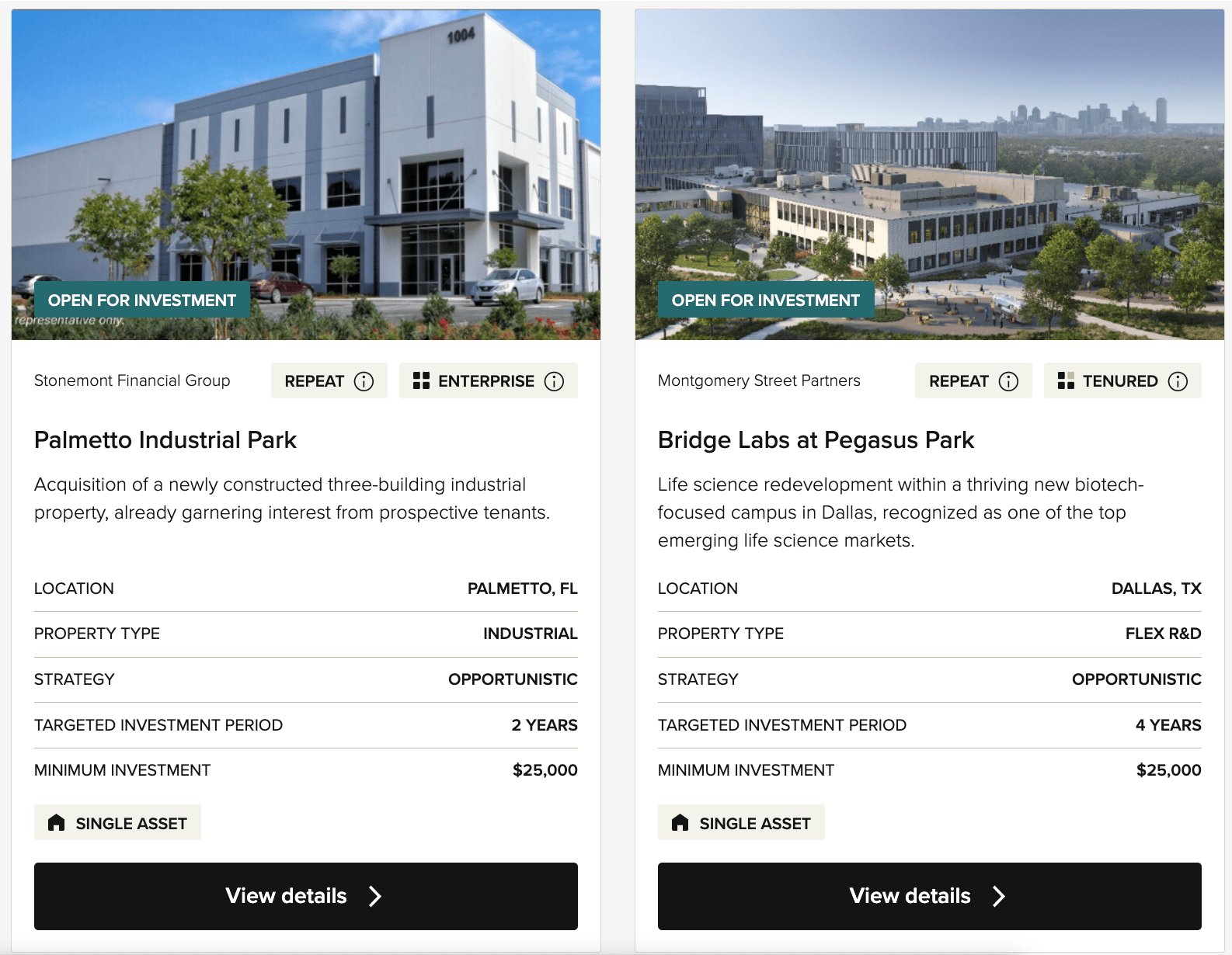

The most effective commercial properties to buy consist of industrial, office, retail, friendliness, and multifamily tasks. For capitalists with a solid focus on enhancing their local areas, industrial property investing can sustain that focus (Accredited Investor Real Estate Crowdfunding). One reason commercial properties are taken into consideration among the most effective kinds of realty financial investments is the possibility for greater money circulation

To find out more concerning beginning in , make certain to review this short article. Raw land investing and new construction stand for 2 types of actual estate financial investments that can diversify a capitalist's profile. Raw land refers to any type of vacant land offered for purchase and is most attractive in markets with high predicted development.

Purchasing brand-new building is likewise prominent in rapidly expanding markets. While many financiers might be unknown with raw land and brand-new construction investing, these financial investment kinds can stand for eye-catching revenues for capitalists. Whether you have an interest in developing a residential or commercial property from begin to end up or benefiting from a lasting buy and hold, raw land and new building and construction provide an unique chance to actual estate financiers.

Is Real Estate For Accredited Investors worth it for accredited investors?

This will ensure you select a preferable area and avoid the investment from being obstructed by market variables. Realty investment company or REITs are companies that possess various business actual estate kinds, such as resorts, stores, offices, shopping centers, or restaurants. You can purchase shares of these realty companies on the stock market.

It is a requirement for REITs to return 90% of their gross income to investors yearly. This uses financiers to obtain returns while diversifying their portfolio at the exact same time. Publicly traded REITs also offer flexible liquidity in comparison to other sorts of realty investments. You can market your shares of the firm on the stock market when you need emergency situation funds.

While this provides the simplicity of discovering assets to capitalists, this kind of realty investment additionally introduces a high amount of threat. Crowdfunding systems are usually limited to approved capitalists or those with a high internet well worth. Some websites provide accessibility to non-accredited capitalists. The major sorts of property financial investments from crowdfunding platforms are non-traded REITs or REITs that are out the stock market.

Why is Real Estate Crowdfunding For Accredited Investors a good choice for accredited investors?

[Learning exactly how to purchase property does not need to be hard! Our online genuine estate spending class has everything you require to reduce the understanding curve and begin buying property in your location.] The very best kind of genuine estate financial investment will certainly depend upon your private conditions, objectives, market location, and preferred investing approach.

Choosing the ideal residential property kind boils down to evaluating each alternative's benefits and drawbacks, though there are a few vital aspects capitalists ought to maintain in mind as they seek the ideal choice. When choosing the very best kind of investment building, the value of place can not be understated. Financiers operating in "up-and-coming" markets might find success with uninhabited land or new building and construction, while financiers operating in more "mature" markets might be interested in household buildings.

Examine your preferred degree of involvement, danger resistance, and success as you determine which residential or commercial property type to spend in. Capitalists wishing to handle a much more easy role may select buy and hold industrial or properties and use a residential or commercial property supervisor. Those wanting to tackle a more active function, on the other hand, might discover creating vacant land or rehabbing household homes to be extra fulfilling.

Table of Contents

Latest Posts

Tax Sale Excess Funds

Surplus Tax Sale

Over The Counter Tax Lien

More

Latest Posts

Tax Sale Excess Funds

Surplus Tax Sale

Over The Counter Tax Lien