All Categories

Featured

After signing up, each prospective buyer will get a bidding number from the Public auction Internet site that will certainly allow the bidder to place quotes. All prospective buyers must make a deposit on the Public auction Website prior to their bids will certainly be accepted. Each prospective buyer will make a deposit equivalent to 10 percent (10%) of the complete dollar quantity of tax obligation liens the bidder prepares for winning.

Tax obligation liens are granted to the highest prospective buyer, or in the event of a connection, the winner will certainly be selected at random by the Auction Internet site, and the winning proposal amount will certainly equal the amount of the tie proposal. Tax liens will certainly be grouped right into sets and offered in one-hour increments beginning on November 6, 2024, at 8:00 a.m.

Workers and authorities of the City and Region of Denver, and participants of their families are not permitted to buy at the Public Auction - tax lien investing software.

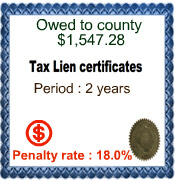

How Do You Invest In Tax Liens

There are no warranties shared or implied regarding whether a tax obligation lien will certainly show to be a rewarding financial investment. The home information accessible on the bid web pages was acquired from the Assessor's office prior to the start of the present auction and is for recommendation just (please note that this building information, provided by the Assessor's office, stands for one of the most current evaluation year, not the tax year connected with this tax obligation lien sale, as taxes are paid one year in debts).

Latest Posts

Tax Sale Excess Funds

Surplus Tax Sale

Over The Counter Tax Lien